Go Digit General Insurance is one of the first digital full-stack insurance companies in India. Established in 2016, Go Digit has quickly gained recognition for its innovative approach to insurance, leveraging technology to provide convenient and affordable coverage to individuals and businesses. Virat Kohli invested INR 2 crore for 266,667 equity shares in January 2020 at INR 75/share. With an estimated price band of INR 930 – INR 940 per equity share for the upcoming IPO which is scheduled to open on June 28, 2023, and close on July 1, 2023, that seems like a very good investment. Let’s delve into some of the insights about Go Digit from its DRHP.

The company’s primary focus is on simplifying the insurance process, eliminating unnecessary paperwork, and delivering seamless customer experiences through its user-friendly online platform. With a wide range of insurance products including motor, travel, health, home, and commercial insurance, Go Digit aims to cater to the diverse needs of its customers. By leveraging data analytics and artificial intelligence, Go Digit strives to offer personalized policies and efficient claim settlement processes, enhancing overall customer satisfaction. As a pioneer in the digital insurance space, Go Digit continues to redefine the insurance industry in India by embracing technology and delivering innovative solutions to meet the evolving needs of its customers.

Why Go Digit needs a IPO?

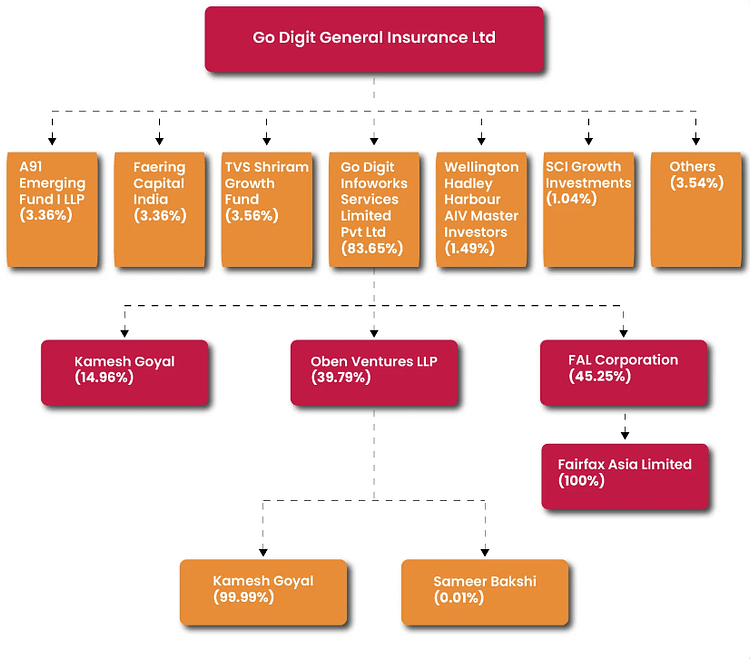

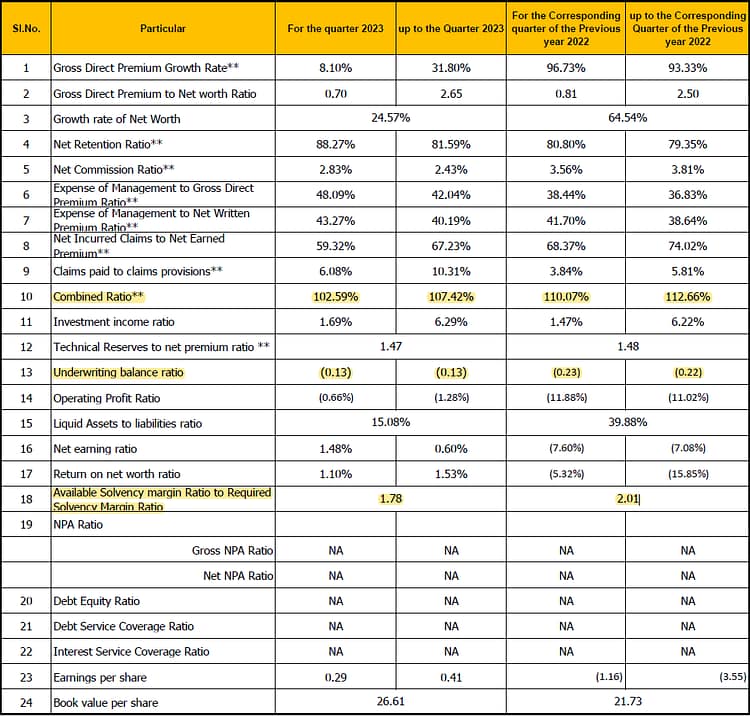

To maintain the solvency ratio. The solvency ratio is an important measure of a general insurance company’s financial strength and ability to meet its obligations. The minimum solvency ratio requirement set by IRDAI for general insurance companies in India is 1.50. This means that for every INR 100 of net premium written, the general insurance company must have a minimum of INR 150 in assets to cover potential claims and other liabilities. Go Digit’s solvency ratio has dropped from 2.01 in FY 2021-22 to 1.78 in FY 2022-23. In comparison, ICICI Lombard’s solvency ratio has increased from 2.46 to 2.51 and Bajaj Allianz’s solvency ratio has improved from 3.44 to 3.91 in the same period.

Hence Go Digit is in urgent need to infuse capital to maintain its solvency ratio. The offer size for the Go DIGIT IPO includes 1,250 crores in fresh equities and an offer of 109,445,561 shares in offer for sale.

- Fresh equities refer to new shares that are being issued by the company. When a company issues fresh equities, it is essentially selling a portion of its ownership to the public. The money raised from the sale of fresh equities is used by the company to fund its growth plans.

- Offer for sale (OFS) refers to the sale of existing shares by existing shareholders. When a shareholder sells their shares through an OFS, they are not selling any part of their ownership in the company. The money raised from the sale of shares through an OFS goes directly to the selling shareholder.

In the case of the Go DIGIT IPO, the 1,250 crores in fresh equities will be used by the company to fund its growth plans. The 109,445,561 shares in offer for sale will be sold by the company’s existing shareholders, and the money raised from the sale will go directly to those shareholders.

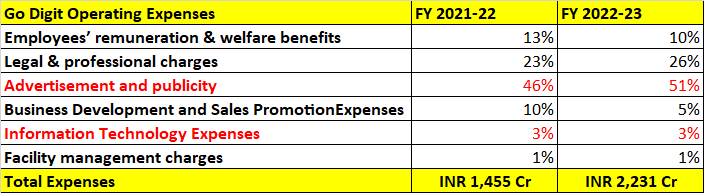

Being a digital full-stack insurance company, Go Digit spends only 3-4% of its money on technology (INR 57 Cr/INR 2,231 Cr). In contrast, ICICI Lombard and Bajaj Allianz, which are not considered digital full-stack insurance company by Go Digit also spends roughly the same percentage, if not more on their IT and tech (ICICI Lombard: INR 179 Cr/ INR 4,514 Cr; Bajaj Allianz: INR 102 Cr/ INR 2,164 Cr)

IRDAI mandated quarterly public disclosures for insurance companies in India to maintain transparency. One can check the FY 2022-23 expenses of Go Digit here, ICICI here and Bajaj here.

Its net earned premium has increased from INR 3,404 Cr in FY 2021-22 to INR 5,163 Cr in FY 2022-23. Go Digit is still in a loss, but operating losses have improved from 3,751 Cr to just INR 66 Cr. Its Combined Ratio ((Incurred losses + Expenses) / Earned premium) has also improved from 112.66% to 107.42%. Only Bajaj can boast of maintaining its CoR near 100%. FY 2023-24 could be the year of profitability. But when it comes to insurance, IBNR and IBNeR are highly important.

- IBNR claims are those that have already occurred but have not yet been reported to the insurer. This can happen for a variety of reasons, such as the policyholder may not be aware that they have a claim, or they may be waiting for the claim to be settled before they report it.

- IBNeR claims are those that have been reported to the insurer, but the amount of the claim is not yet known. This can happen for a variety of reasons, such as the claim is still under investigation, or the policyholder may not have provided all of the necessary information to the insurer.

These concepts are essential for ensuring the financial health of insurers. By carefully estimating the amount of IBNR and IBNeR claims, insurers can mitigate their financial risk and protect their policyholders. If an insurer underestimates the amount of IBNR and IBNeR claims, it could lead to a shortfall in its reserves. This could make it difficult for the insurer to meet its financial obligations, and could even lead to its collapse. Fo Go Digit, IBNR and IBNeR have increased from 2,931 Cr at the end of FY 2021-22 to INR 4,113 Cr at the end of FY 2022-23.

What does current General Insurance landscape look like?

The advent of technology has sparked numerous advancements within the conventional insurance value chain. These include the implementation of artificial intelligence/machine learning (AI/ML) for predictive underwriting, the automation of marketing and sales campaigns, the introduction of dynamic pricing, the utilization of data analytics, and the automation of processes for servicing and claims management.

Automated demand analysis and Big Data insights have revolutionized the product development process, replacing traditional market research and customer needs analysis. These advanced techniques allow for a comprehensive understanding of customer requirements and facilitate faster launch of insurance products.

AI/ML-based risk modeling and predictive underwriting are disrupting the conventional manual underwriting processes. The integration of IoT and telematics enables more efficient risk analysis by utilizing large data sets, leading to the customization of insurance products with flexible pricing for individual customers. Through the utilization of AI systems that evaluate application profiles against extensive data from various sources, underwriters gain valuable insights into the most relevant risk factors. Predictive ML solutions allow non-life insurers to swiftly generate fairly-priced quotes, resulting in enhanced profitability through optimized pricing strategies. AI-assisted underwriting combines robotic process automation with human expertise, automating routine tasks while reserving human attention for complex decision-making. Consequently, AI/ML-based underwriting significantly improves efficiency compared to traditional manual underwriting. The digitization and automation of processes are replacing the reliance on physical form submissions, manual data entry, intricate procedures, and providing greater transparency in traditional servicing and policy administration.

The general insurance industry utilizes various distribution channels, including individual agents, corporate agents, brokers, referrals, micro-insurance agents, and direct business channels. The direct distribution also encompasses digital channels such as online portals, web aggregation, and online brokers.

In 2018, the introduction of the IRDAI broking license made the insurance business more customer-centric. Brokers gained the ability to sell policies from multiple insurers, providing customers with more options to purchase insurance. Brokers and agents have played a crucial role in extending non-life insurance coverage to Tier 2 and Tier 3 cities in India. The IRDAI’s introduction of the POSP license in 2015 allowed individuals with minimal prior training to partner with insurers and brokers, enabling them to sell insurance part-time. This has led to further penetration of non-life insurance, particularly in motor and health insurance.

The IRDAI’s 2022 amendment regulations for insurance intermediaries strongly focus on expanding insurance coverage throughout the country. The aim is to enhance insurance penetration by offering policyholders a wider choice and access to purchase insurance through various distribution channels.

In FY 2022, approximately 18 to 22% of the motor insurance premiums were distributed digitally and approximately 10 to 12% of retail health insurance premiums were distributed digitally

While 3.3% may seem low, digital penetration here refers to the total GWP by full-stack digital insurers only, namely Acko General Insurance Limited, Go Digit General Insurance Limited & Navi General Insurance Limited. In reality, the digital penetration would be higher due to the increased focus of ICICI/Bajaj and other general insurers on the digitization of the insurance value chain.

How Go Digit is digitizing insurance?

1. Go Digit’s technology platform plays a crucial role in supporting its product design. It enables the incorporation of a modular product architecture and serves as the foundation for their application program interfaces (APIs), applications, portals, and websites, providing customers and partners with convenient ways to engage with them.

As a pioneer in the Indian non-life insurance sector, Go Digit is fully operated on the cloud. Their cloud-based infrastructure allows them to run sophisticated AI models, scale rapidly through a pay-per-use model, and benefit from efficient storage options and faster disaster recovery capabilities. They have established application programming interface (API) integrations with numerous channel partners. By December 31, 2022, they had successfully integrated 1,435 APIs with partners, resulting in 25.01 million policies issued since their inception. Go Digit harnesses the power of artificial intelligence and machine learning to enhance the automation of application processing and claims. Additionally, Go Digit has developed predictive underwriting models that leverage insights from their vast data bank. These models help identify and target profitable markets and customers in India, enabling them to accurately price their coverage.

Go Digit recognizes the significance of the young demographic as an essential customer group. They aim to build long-term relationships with this segment, recognizing its potential and value.

2. Focus on accuracy of assessment and pricing of risk

Predictive underwriting models are used to improve risk selection and identify low-risk customers as compared to high-risk customers and thereby arrive at appropriate pricing. Go Digit uses variables including:

- Fuel

- Vehicle make, model, and subtype

- Odometer reading

- Vehicle location

- Coverages opted

- Sourcing channel

- Past claim history

- Usage of vehicles

These variables help improve the granularity of risk selection using predictive underwriting models. This enables Go Digit to charge an appropriate price to each customer, thereby lowering the loss ratio to generate favorable economics.

3. Efficient, scalable operating platform

4. Go Digit has established a range of accessible channels and tools for its partners to engage with them. These include Aria, an in-house AI-powered bot that assists distribution partners in generating real-time quotes for marine and group health insurance products without the need for human intervention. In addition, Go Digit offers APIs, a partner portal, mobile applications, and a website, each optimized to facilitate seamless and efficient interactions with their partners.

5. Go Digit collaborates with its partners to provide digital insurance solutions that can be accessed at the point of sale. This empowers partners to enhance the customer experience by offering a comprehensive suite of services. They have dedicated teams that support Point of Sale Persons (POSPs) with onboarding and training, providing self-assisted online onboarding, along with continuous classroom and online training opportunities through mobile apps. Leveraging their technology infrastructure, each relationship manager on the POSP management team can efficiently handle a significant number of POSPs, often exceeding 600.

6. The modular APIs developed by Go Digit are designed to cater to the specific requirements of their partners. This allows for seamless integration with partner platforms, automating various distribution and customer support processes. For instance, they have created APIs that facilitate a complete integration of the quote process, policy endorsements and cancellations, payments, and claims registration with partner systems.

7. Go Digit’s online platform equips partners with valuable insights and a comprehensive suite of tools. This empowers partners to better understand, target, acquire, and service their business. They offer information about risk profiles across different geographies and products during the quoting process for select product lines. This information enhances partners’ understanding of the types of business Go Digit is likely to underwrite, enabling them to focus their distribution efforts accordingly. Partners can also determine appropriate discounts based on individualized risk profiles, tailoring product offerings to customers.

8. From policy issuance to endorsement, reconciliation, and claims processes, Go Digit provides partners with self-service tools. These tools enable partners to efficiently manage their portfolios and deliver exceptional service to their customers. Partners can conduct pre-inspections and self-inspections, as well as upload documents through the Go Digit app, web link, or APIs.

9. Technology-backed insurance value chain of Go Digit

Go Digit’s technology platform is specifically designed to digitally store and efficiently retrieve all the data collected across their underwriting lines of business. This integrated technology stack, developed entirely in-house, plays a pivotal role in enabling their business model and overall strategy. Customer interactions conducted through their platform generate valuable data, which in turn helps enhance future customer interactions.

Go Digit leverages the information stored in their data bank, along with publicly available data from various external sources, to fuel their predictive underwriting models and support customers, partners, and internal processes. This includes utilizing data such as credit bureau scores, vehicle registration and driver’s license numbers, previous claims history, flood scores, and delayed flight information. They do utilize certain APIs, such as Vahan, Credit Bureaus, NSDL, and Insurance Information Bureau, either directly or indirectly to access data primarily for facilitating underwriting and claims processes. In 2018, the company incurred ₹1,581,200 in expenses to obtain such data.

10. Artificial Intelligence & Machine Learning

Go Digit generates on-demand policy and portfolio-level reports for themselves and their partners, offering real-time access to application and claims status. These reports provide a comprehensive view of the partner’s book of business, including information on premiums, renewal premiums, claims experience, and other key data points.

Go Digit efficiently organizes health documents shared by individuals, accurately categorizing them before inspection by underwriters or claims experts. This streamlines the process, reducing effort and time required for document handling.

Through their AI-driven microsystems, Go Digit enhances straight-through processing during motor applications. This automation results in a significant percentage of claims being settled automatically without human intervention. In the specified periods, 15.2% and 16.6% of claims were handled through automated pre-inspection for the nine months ended December 31, 2022, and Fiscal 2022, respectively.

In cases of car damage, Go Digit enables individuals to upload pictures of the damage from their smartphones, reducing inspection time. They provide a link for easy submission, streamlining the claims process and improving efficiency.

Go Digit collaborates with technology platforms to automate critical processes. By leveraging AI-driven analytics and their extensive data bank, they can auto-populate information for online application and claims forms. This automation accelerates processes, reduces errors, and enhances overall efficiency.

Go Digit’s microsystems perform tasks in a fast and consistent manner, minimizing errors and reducing the need for manual intervention. As of December 31, 2022, they successfully processed 87.7% of motor own damage surveys digitally, thanks to the implementation of their microsystems.

11. Digital Distribution and Policy Administration

Go Digit has a Digit Partner App, WhatsApp service for self-service for partners and a portal for human resources department of corporates for group medical cover.

12. App-based Claims Processing

During the nine-month period ending December 31, 2022, and Fiscal 2022, the majority of claims reported for motor own damage insurance policies (59.3% and 54.0% of claims respectively) were initiated within the app. Customers confirm policy details and provide incident information, including uploading photos guided by the application. The app directs customers to capture specific photo angles that assist in assessing the damage. Claims are then triaged based on complexity and severity and assigned to experienced claim processors. Throughout the process, customers can track their claim status and contact customer care if needed. On average, the settlement time for private car insurance claims, including repair time, is approximately 14 days.

For health claims, Go Digit have deployed image recognition technology, which converts scanned hospital documents into digital entries and auto populates the information in various fields, such as hospital name, patient name, bill date, bill number, expense category, quantity and bill amount, etc.

Overall, Go Digit’s technology is a key enabler of its growth and success. Go Digit showcases an exceptional technology-driven approach in the Indian insurance industry. Their innovative use of AI, machine learning, and predictive underwriting models sets them apart. With a focus on customer-centric solutions, Go Digit’s technology empowers them to provide efficient services, personalized products, and accurate risk assessment. As the company prepares for its IPO, its technology is a valuable asset that will help it to continue to grow and succeed in the years to come.

Note: In case you are looking for a Product Management course, I would highly recommend joining this cohort-based course – ISB Executive Education – Product Management program

PS: You can connect with me for review or referral discount (link for referral discount)