Managing General Agents (MGAs) are specialized entities operating within the insurance and reinsurance industries. They play a crucial role in facilitating the distribution and underwriting of insurance policies on behalf of insurers and reinsurers. Reinsurance MGAs act as intermediaries between these primary insurers and reinsurers, providing essential services and expertise to both parties.

MGAs are typically independent entities or specialized divisions of reinsurance companies that have been granted underwriting authority by reinsurers. This authority allows them to assume risks and issue policies on behalf of the reinsurers. They operate under binding authority agreements, which define the terms and conditions of their underwriting authority and establish the scope of their responsibilities.

Role of an MGA in the Reinsurance Landscape

Advantages of Utilizing an MGA in Reinsurance

Challenges Faced by MGA in Reinsurance

Emerging Trends in MGA in Reinsurance

Evaluating MGA in Reinsurance: Factors to Consider Before Partnering

Profit Sharing Arrangements between MGA and Reinsurer

Successful MGAs in Reinsurance Partnerships

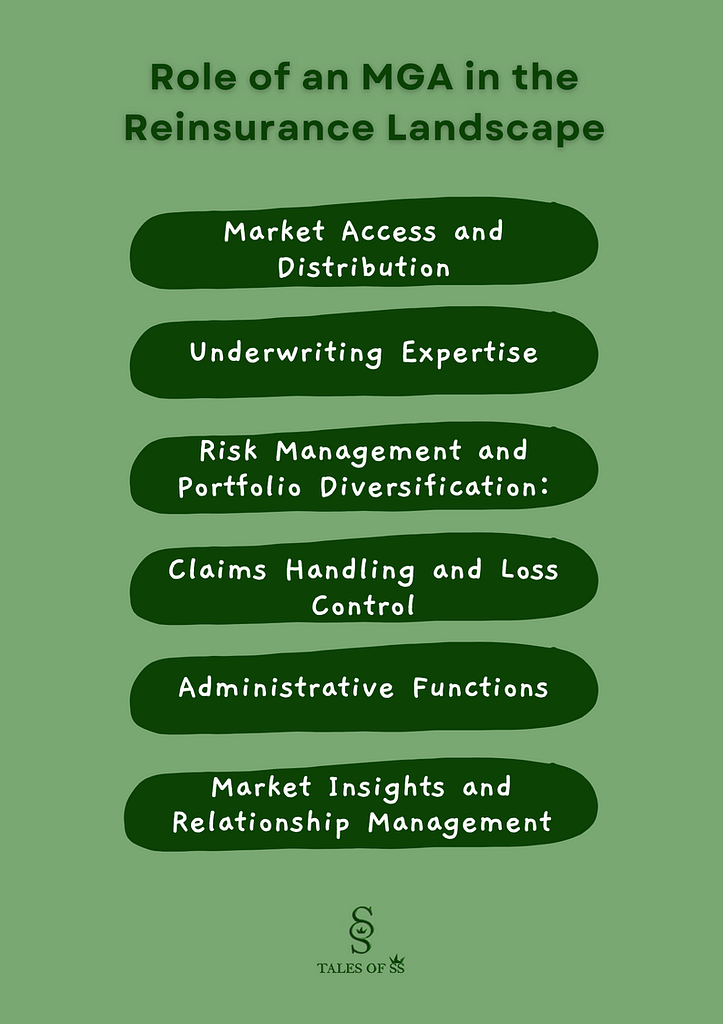

Role of an MGA in the Reinsurance Landscape

MGAs play a significant role in the reinsurance landscape, serving as essential intermediaries between primary insurers and reinsurers. Here are some key aspects of their role:

Market Access and Distribution: One of the primary roles of MGAs is to provide primary insurers with access to reinsurance markets. They have established relationships with reinsurers and leverage their expertise to connect primary insurers with the right reinsurers for their specific needs. MGAs utilize their distribution channels and market knowledge to facilitate the placement of reinsurance coverage, expanding the reach of primary insurers in the reinsurance marketplace.

Example: XYZ MGA specializes in cyber insurance and has established relationships with multiple reinsurers that offer cyber reinsurance coverage. They work closely with primary insurers to connect them with the appropriate reinsurers based on the insurers’ specific needs and risk profiles. Through their market access and distribution channels, XYZ MGA helps primary insurers access the cyber reinsurance market efficiently.

Underwriting Expertise: MGAs possess specialized underwriting expertise in specific lines of business or niche markets. They have in-depth knowledge of the associated risks, underwriting guidelines, and pricing models. MGAs utilize this expertise to assess risks accurately and determine the terms and conditions of coverage. Their underwriting capabilities allow them to customize insurance solutions and provide primary insurers with access to specialized reinsurance products and services.

Example: ABC MGA focuses on underwriting marine cargo insurance. They have a team of underwriters with extensive knowledge and experience in assessing risks related to marine cargo. ABC MGA analyzes cargo transportation risks, determines appropriate coverage terms, and sets premium rates based on their understanding of the market and risk dynamics. Primary insurers benefit from ABC MGA’s specialized underwriting expertise in the marine cargo insurance sector.

Risk Management and Portfolio Diversification: MGAs assist primary insurers in managing risks and optimizing their portfolios. They evaluate risks on behalf of reinsurers, ensuring that the risks accepted are within predefined guidelines and align with the reinsurers’ risk appetite. By leveraging their underwriting authority, MGAs enable primary insurers to diversify their risk exposures and enhance their overall risk management strategies.

Example: DEF MGA specializes in providing reinsurance solutions for catastrophic events. They work closely with primary insurers to evaluate their portfolios and identify potential risks related to natural disasters, such as hurricanes or earthquakes. DEF MGA assists primary insurers in diversifying their risk exposures by offering catastrophe reinsurance coverage, ensuring the financial stability of insurers in the face of large-scale losses.

Claims Handling and Loss Control: MGAs often handle claims on behalf of reinsurers. They have the necessary expertise and resources to efficiently process and settle claims. MGAs play a crucial role in ensuring timely and fair claims resolution, thereby enhancing the overall claims management process for primary insurers and reinsurers. Additionally, they may offer loss control and risk mitigation services, helping primary insurers reduce losses and improve risk profiles.

Example: GHI MGA focuses on handling claims in the property and casualty sector. They have a dedicated claims team that efficiently processes and settles claims on behalf of reinsurers. GHI MGA’s expertise in claims management enables primary insurers to benefit from streamlined claims handling, ensuring prompt and fair resolution for policyholders and reinsurers.

Administrative Functions: MGAs undertake various administrative tasks related to policy issuance, premium collection, policy documentation, and reporting. They ensure that policies are issued accurately and in compliance with regulatory requirements. MGAs also handle the collection and remittance of premiums to reinsurers, streamlining the administrative processes for primary insurers and reinsurers

Example: JKL MGA offers administrative support to primary insurers and reinsurers in the workers’ compensation insurance market. They handle policy issuance, premium collection, and policy documentation tasks. JKL MGA ensures that policies are issued accurately and in compliance with regulatory requirements, relieving administrative burdens for primary insurers and reinsurers.

Market Insights and Relationship Management: MGAs actively monitor market trends, regulatory changes, and emerging risks. They provide primary insurers with valuable market insights and assist them in staying informed about industry developments. Additionally, MGAs maintain relationships with reinsurers, facilitating effective communication and collaboration between primary insurers and reinsurers

Example: MNO MGA specializes in specialty lines of insurance, such as aviation insurance. They actively monitor the aviation insurance market, stay updated on industry trends, and provide primary insurers with market insights. MNO MGA maintains strong relationships with reinsurers specializing in aviation reinsurance, facilitating effective communication and collaboration between primary insurers and reinsurers in the aviation insurance sector.

MGAs play a crucial role in the reinsurance landscape by providing reinsurers with market access, underwriting expertise, risk management services, and administrative support. Their intermediary position helps bridge the gap between primary insurers and reinsurers, facilitating efficient and effective reinsurance arrangements.

Advantages of Utilizing an MGA in Reinsurance

Utilizing a Managing General Agent (MGA) in reinsurance offers several advantages for primary insurers and reinsurers. Here are some key advantages:

Specialized Expertise: MGAs often focus on specific lines of business or niche markets, developing specialized expertise in those areas. By partnering with an MGA, primary insurers gain access to the MGA’s deep understanding of the risks and underwriting requirements associated with that specific line of business. This expertise helps primary insurers make informed underwriting decisions, leading to more accurate risk assessments and improved profitability.

Market Access and Relationships: MGAs have established relationships with reinsurers and maintain market access to the reinsurance marketplace. This allows primary insurers to tap into a broader range of reinsurance solutions and capacity. MGAs act as intermediaries, leveraging their connections to find the most suitable reinsurers for the specific needs of primary insurers. This expands the primary insurer’s options, improves reinsurance placement efficiency, and helps optimize coverage terms and pricing.

Enhanced Underwriting Efficiency: MGAs streamline the underwriting process as they have the authority to underwrite risks on behalf of the reinsurer or primary insurer, within the agreed-upon guidelines and limits This reduces the need for constant back-and-forth communication with reinsurers, leading to quicker turnaround times and improved operational efficiency.

Risk Management and Portfolio Diversification: MGAs play a vital role in risk management and portfolio diversification for primary insurers. They assess risks on behalf of reinsurers and provide valuable insights and guidance to primary insurers. MGAs help primary insurers diversify their risk exposures by accessing specialized reinsurance products and capacity. This enables primary insurers to optimize their risk portfolios, enhance their overall risk management strategies, and mitigate potential losses.

Claims Handling Expertise: MGAs often offer claims handling services, ensuring efficient and effective claims resolution. They have dedicated claims teams with expertise in managing claims on behalf of reinsurers. By leveraging their claims handling capabilities, primary insurers can benefit from expedited claims processing, accurate claim assessments, and fair claims settlements. This leads to improved customer satisfaction and helps maintain positive relationships with policyholders.

Tailored Solutions and Innovation: MGAs have the flexibility to design and develop customized insurance solutions based on the specific needs of primary insurers and the market they serve. They can adapt coverage terms, pricing structures, and policy features to meet the unique requirements of primary insurers and their target markets. MGAs often foster innovation in the insurance industry by staying updated on emerging risks and developing new insurance products to address evolving market demands.

Utilizing an MGA in reinsurance offers advantages such as specialized expertise, market access, enhanced underwriting efficiency, risk management support, efficient claims handling, tailored solutions, and access to innovative insurance products. These advantages help primary insurers optimize their operations, expand their market reach, and improve their overall profitability and competitiveness in the reinsurance landscape.

Challenges Faced by MGA in Reinsurance

While there are several advantages to utilizing Managing General Agents (MGAs) in reinsurance, there are also certain challenges that need to be addressed. Here are some common challenges and ways to overcome them in the MGA reinsurance space:

Regulatory Compliance: MGAs must navigate complex regulatory frameworks to ensure compliance with applicable laws and regulations. This includes obtaining necessary licenses, meeting reporting requirements, and adhering to consumer protection and privacy regulations. To overcome this challenge, MGAs should establish robust compliance processes, stay updated on regulatory changes, and collaborate closely with legal and regulatory experts to ensure adherence to all relevant requirements.

Underwriting Authority and Risk Appetite Alignment: While MGAs are granted underwriting authority by reinsurers, aligning their risk appetite with that of the reinsurer can be challenging. It is crucial to establish clear guidelines and communication channels between the MGA and reinsurer to ensure consistency in risk assessment and acceptance. Regular discussions and feedback mechanisms can help align risk appetites and mitigate potential conflicts.

Market Competition and Differentiation: The MGA reinsurance landscape can be highly competitive, with multiple players vying for market share. To overcome this challenge, MGAs should focus on differentiation by specializing in niche markets, developing unique expertise, and providing innovative solutions tailored to the needs of primary insurers. Building strong relationships with reinsurers and providing exceptional service can also help differentiate an MGA from competitors.

Data Management and Technology: Effective data management and technology infrastructure are vital for MGAs in reinsurance. MGAs must handle large volumes of data related to underwriting, claims, and regulatory reporting. Implementing robust data management systems, utilizing advanced analytics, and adopting technology solutions that streamline processes can enhance operational efficiency and improve decision-making.

Claims Handling and Disputes: Efficient claims handling is crucial in the reinsurance space. MGAs may face challenges related to claim assessment, settlement, and potential disputes. To overcome these challenges, MGAs should establish well-defined claims handling processes, invest in skilled claims professionals, and prioritize effective communication and collaboration with reinsurers and primary insurers to ensure prompt and fair claims resolution.

Market Volatility and Risk Management: The reinsurance market is subject to fluctuations in pricing, capacity, and overall market conditions. MGAs must effectively manage these risks and adapt to changing market dynamics. Implementing robust risk management practices, maintaining a diverse panel of reinsurers, and regularly assessing and adjusting underwriting strategies can help MGAs navigate market volatility and mitigate potential adverse impacts.

Technology Integration and Interoperability: Integrating MGA systems with primary insurers and reinsurers’ technology platforms can be a challenge. Seamless data exchange and interoperability are essential for efficient operations. MGAs should prioritize technology integration efforts, establish data standards, and collaborate closely with their partners to ensure smooth information flow and enhance operational efficiency.

By addressing these challenges through proactive planning, effective communication, investment in technology and talent, and a focus on compliance and risk management, MGAs in reinsurance can position themselves for long-term success and sustainable growth in the dynamic reinsurance market.

Emerging Trends in MGA in Reinsurance

The MGA (Managing General Agent) model in reinsurance is evolving to adapt to emerging trends in the industry. Here are some key trends shaping the future of MGAs in reinsurance:

Insurtech Integration: MGAs are leveraging technology and insurtech solutions to enhance their operations. This includes adopting advanced analytics, artificial intelligence (AI), and machine learning (ML) capabilities to streamline underwriting processes, improve risk assessment, and optimize portfolio management. Insurtech integration also enables efficient data management, enhanced customer experiences, and better collaboration with primary insurers and reinsurers.

Data Analytics and Predictive Modeling: MGAs are increasingly utilizing data analytics and predictive modeling techniques to gain insights into risk profiles, pricing models, and market trends. By harnessing big data and advanced analytics tools, MGAs can make data-driven underwriting decisions, identify emerging risks, and improve risk management practices. Predictive modeling helps optimize pricing, enhance portfolio performance, and support more accurate risk assessments.

Focus on Cyber Risk and Emerging Risks: MGAs are recognizing the growing importance of cyber risk and other emerging risks in the reinsurance landscape. They are developing specialized expertise in underwriting and managing cyber insurance, as well as other emerging risks such as climate change-related perils. MGAs are actively partnering with reinsurers and primary insurers to provide tailored solutions and support in managing these evolving risks.

Collaborative Ecosystems: MGAs are increasingly embracing collaboration and partnerships within the reinsurance ecosystem. This includes forming strategic alliances with insurtech startups, reinsurers, and primary insurers. Collaborative ecosystems allow MGAs to access innovative technologies, expand market reach, and share knowledge and resources. Such partnerships foster innovation, improve efficiency, and enhance customer experiences.

Emphasis on Customer Experience: MGAs are recognizing the importance of delivering exceptional customer experiences to primary insurers and policyholders. They are investing in digital tools, user-friendly platforms, and streamlined processes to enhance accessibility, efficiency, and transparency. MGAs are also focusing on personalized and tailored insurance solutions that cater to the evolving needs and preferences of customers.

Regulatory and Compliance Evolution: Regulatory landscapes are evolving, and MGAs are adapting to comply with changing requirements. They are actively monitoring regulatory developments and adjusting their processes and practices accordingly. MGAs are investing in compliance tools, automation, and robust governance frameworks to ensure adherence to regulatory guidelines.

Environmental, Social, and Governance (ESG) Considerations: MGAs are increasingly integrating ESG considerations into their underwriting and risk management practices. They are evaluating the sustainability and ethical aspects of risks and investments. MGAs are aligning themselves with responsible underwriting practices and participating in initiatives related to climate change, social impact, and sustainability.

These emerging trends highlight the ongoing transformation of MGAs in reinsurance, driven by technology, customer-centricity, risk awareness, and collaboration. By embracing these trends, MGAs can position themselves as agile, innovative, and valuable partners in the reinsurance ecosystem.

Evaluating MGA in Reinsurance: Factors to Consider Before Partnering

When considering a partnership with a Managing General Agent (MGA) in the reinsurance space, it’s important to evaluate several factors to ensure a successful collaboration. Here are key factors to consider before partnering with an MGA:

Expertise and Specialization: Assess the MGA’s expertise and specialization in the specific line of business or market segment that aligns with reinsurance needs. Evaluate their track record, industry knowledge, underwriting capabilities, and understanding of emerging risks. A specialized MGA with deep expertise can provide valuable insights, underwriting excellence, and tailored solutions.

Market Access and Relationships: Consider the MGA’s market access and relationships with reinsurers. Evaluate MGA’s network, including the breadth and depth of reinsurers they work with. A well-connected MGA can offer access to a wide range of reinsurance solutions, capacity, and pricing options. Strong relationships with reinsurers also facilitate efficient placement and improved collaboration.

Financial Stability and Security: Assess the MGA’s financial stability and security. Look into their financial strength ratings, capitalization, and risk management practices. A financially secure MGA provides assurance of their ability to meet obligations, handle claims, and navigate market challenges. Additionally, evaluate their reinsurance protection and risk transfer arrangements to ensure adequate protection for primary insurers.

Underwriting and Risk Management Processes: Understand the MGA’s underwriting and risk management processes. Evaluate their risk selection criteria, underwriting guidelines, and risk appetite alignment with your business objectives. Assess their approach to risk assessment, policy wording, and claims handling. Effective underwriting and risk management processes are crucial for sound decision-making and sustainable partnerships.

Technology and Data Capabilities: Evaluate the MGA’s technology infrastructure, data management capabilities, and digital solutions. A technologically advanced MGA can streamline processes, improve operational efficiency, and enhance data analytics capabilities. Look for features such as automated underwriting systems, data-driven insights, and secure data exchange capabilities that align with your technology requirements.

Claims Handling and Service: Assess the MGA’s claims handling capabilities and service levels. Evaluate their claims processes, customer service track record, and ability to provide prompt and fair claims resolution. Effective claims handling is essential for maintaining positive relationships with policyholders and ensuring a smooth claims experience.

Regulatory Compliance and Governance: Consider the MGA’s regulatory compliance track record and its adherence to relevant laws, regulations, and licensing requirements. Evaluate their governance structure, risk management frameworks, and internal controls. A compliant and well-governed MGA demonstrates a commitment to ethical practices and mitigates potential regulatory risks.

Reputation and References: Seek feedback and references from industry peers, reinsurers, and other partners who have worked with the MGA. Assess their reputation, reliability, and professionalism. References can provide valuable insights into the MGA’s strengths, weaknesses, and overall performance.

Cultural Fit and Collaboration: Evaluate the cultural fit and compatibility between your organization and the MGA. Consider their communication style, responsiveness, and willingness to collaborate. Effective collaboration requires strong alignment in terms of goals, values, and expectations.

By carefully evaluating these factors, a reinsurer can make an informed decision when selecting an MGA partner in reinsurance. It’s crucial to find an MGA that aligns with reinsurer’s business objectives, complements its capabilities, and can effectively meet its needs

Profit Sharing Arrangements between MGA and Reinsurer

Profit sharing arrangements between Managing General Agents (MGAs) and reinsurers are common in the reinsurance industry. These arrangements allow both parties to share in the financial outcomes of the business underwritten by the MGA.

Basis of Profit Sharing: Profit sharing arrangements are typically based on predefined metrics or formulas agreed upon between the MGA and the reinsurer. The metrics can vary depending on the specific agreement and may include factors such as premium volume, loss ratio, combined ratio, or other performance indicators.

Sharing of Profits: When the actual financial results of the business underwritten by the MGA meet or exceed the agreed-upon metrics, the profits are shared between the MGA and the reinsurer. The sharing ratio or percentage is determined in the profit sharing agreement. For example, the MGA might receive a certain percentage of the profits, while the reinsurer retains the remaining portion.

Performance Adjustments: Profit sharing arrangements often include provisions for performance adjustments. These adjustments can be based on factors like the loss experience of the business, claims development, expense ratios, or other risk factors. Performance adjustments help ensure that profit sharing is aligned with the actual performance of the underwritten business.

Transparency and Reporting: Clear and transparent reporting is crucial in profit sharing arrangements. The MGA is responsible for providing accurate and timely financial reports to the reinsurer, detailing the underwriting results, premiums earned, claims incurred, and any other relevant financial data. This transparency enables both parties to assess the profitability of the business and calculate the appropriate profit sharing amounts.

Agreement Terms and Renewals: Profit sharing arrangements are typically set for a specific period, often coinciding with the duration of the underwriting agreement between the MGA and the reinsurer. Upon renewal, the profit sharing terms can be renegotiated based on the performance of the previous period and market conditions.

Incentives and Alignment: Profit sharing arrangements provide incentives for the MGA to underwrite and manage the business profitably. By sharing in the profits, the MGA has a vested interest in maintaining underwriting discipline, managing risks effectively, and achieving favorable financial outcomes. This alignment of interests encourages responsible underwriting and risk management practices.

It’s important to note that profit sharing arrangements can vary significantly based on the specific agreement between the MGA and the reinsurer. The terms, metrics, and sharing ratios are typically negotiated based on factors such as the MGA’s underwriting expertise, market conditions, and the nature of the business being underwritten.

Overall, profit sharing arrangements between MGAs and reinsurers create a mutually beneficial relationship where both parties have a stake in the financial performance of the underwritten business. These arrangements encourage collaboration, risk management, and profitability while aligning the interests of the MGA and the reinsurer.

Successful MGAs in Reinsurance Partnerships

A few real-world examples that showcase the effectiveness of MGAs in the reinsurance industry:

Ascot Underwriting Asia: Ascot Underwriting Asia is an MGA that specializes in underwriting specialty risks in the Asia-Pacific region. They provide primary insurers with access to Ascot Reinsurance, a leading global reinsurer. Ascot Underwriting Asia’s expertise in the region and their relationship with Ascot Reinsurance enables them to offer tailored reinsurance solutions to primary insurers. Their effective underwriting capabilities and market access have helped them build a strong presence and deliver value to their clients.

MGA Systems: MGA Systems is a technology-driven MGA platform that provides underwriting and policy administration solutions. Their platform allows MGAs to efficiently manage the entire policy lifecycle, from underwriting to claims handling. By leveraging advanced technology and automation, MGA Systems enables MGAs to streamline their operations, improve underwriting efficiency, and enhance customer experiences. Their platform has been widely adopted by MGAs, demonstrating its effectiveness in driving operational excellence.

Bolt Solutions Inc.: Bolt Solutions Inc. is an MGA that focuses on providing digital distribution and sales solutions for insurance products. Their platform, called Bolt Platform, offers a seamless online experience for purchasing insurance products, enabling primary insurers and MGAs to reach customers through various channels. Bolt Solutions Inc.’s innovative approach has revolutionized the insurance distribution process, making it more efficient, customer-centric, and cost-effective.

Ardonagh Group: Ardonagh Group is a leading insurance broker and MGA platform that operates in the United Kingdom. They provide a range of services, including underwriting and distribution capabilities, to primary insurers. Through their MGA platform, Ardonagh Group has facilitated the growth and success of numerous MGAs across different lines of business. Their comprehensive suite of services and industry expertise have made them a trusted partner for MGAs seeking support and market access.

These examples demonstrate how MGAs can effectively leverage their expertise, market access, and technology to deliver value to primary insurers and reinsurers. They highlight the importance of specialization, innovative technology solutions, and collaborative ecosystems in the success of MGAs in the reinsurance landscape.

Note: In case you are looking for a Product Management course, I would highly recommend joining this cohort-based course – ISB Executive Education – Product Management program

PS: You can connect with me for review or referral discount (link for referral discount)