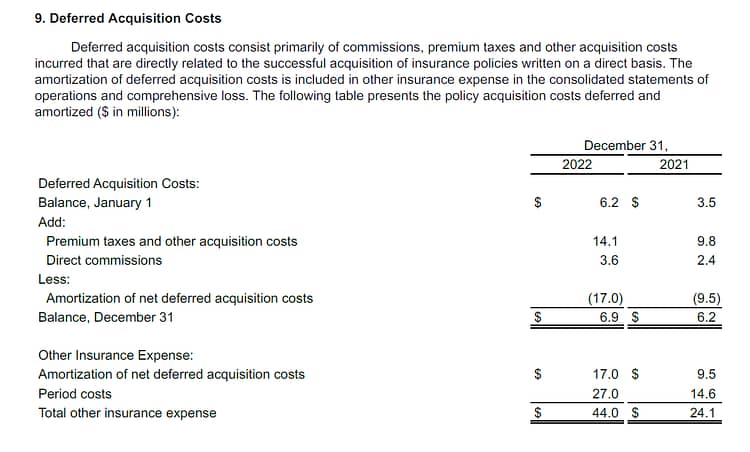

What is Deferred Acquisition Cost?

Deferred Acquisition Costs (DAC) refer to the costs incurred by insurance companies or other entities in acquiring new insurance policies or contracts. These costs typically include commissions, underwriting expenses, and other direct costs associated with issuing new policies.

When an insurance company sells a policy, it expects to receive premium payments from the policyholder over the policy’s duration. However, the costs incurred in acquiring and issuing the policy are immediate expenses. To match the costs with the revenue generated from the policy, insurance companies use the concept of deferred acquisition costs.

Instead of recognizing all the acquisition costs as expenses immediately, insurance companies capitalize these costs and defer their recognition over the life of the insurance policies. The deferred acquisition costs are amortized, or gradually expensed, over the expected policy term in proportion to the earned premium revenue. This practice aligns the recognition of expenses with the recognition of revenue, providing a more accurate representation of an insurance company’s financial performance.

The amortization of deferred acquisition costs reduces the amount of income reported by insurance companies in the early years of a policy’s life, as the costs are gradually recognized as expenses. However, as the policies generate premium revenue, the deferred acquisition costs are gradually depleted, resulting in higher reported income over time.

It’s important to note that the specific accounting treatment of deferred acquisition costs may vary depending on the accounting standards applicable in a particular jurisdiction, such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS). Therefore, the exact presentation and disclosure of deferred acquisition costs may differ among companies and regions.

Sample Example of Defered Acquisition Cost

Suppose ABC Insurance Company sells a life insurance policy with a term of 10 years. The total acquisition costs associated with issuing this policy amount to $10,000, which includes commissions, underwriting expenses, and other direct costs. ABC Insurance Company decides to defer and amortize these costs over the 10-year policy term.

In the first year, the company earns $1,000 in premium revenue from the policy. To align the recognition of expenses with the revenue earned, ABC Insurance Company amortizes a portion of the deferred acquisition costs. Let’s assume the amortization rate is 10% per year.

Year 1: Premium revenue earned: $1,000 Amortization of deferred acquisition costs: 10% x $10,000 = $1,000 Net income reported: $1,000 – $1,000 = $0

In the first year, the entire premium revenue is offset by the amortization of deferred acquisition costs. As a result, no net income is reported, indicating that the company has not yet fully recovered the costs associated with acquiring the policy.

Now let’s consider subsequent years:

Year 2: Premium revenue earned: $1,200 Amortization of deferred acquisition costs: 10% x $9,000 (remaining DAC after Year 1) = $900 Net income reported: $1,200 – $900 = $300

Year 3: Premium revenue earned: $1,400 Amortization of deferred acquisition costs: 10% x $8,100 (remaining DAC after Year 2) = $810 Net income reported: $1,400 – $810 = $590

As the policy continues, the premium revenue gradually increases, while the amortization of deferred acquisition costs decreases. This leads to higher reported net income over time.

Year 10: Premium revenue earned: $2,000 Amortization of deferred acquisition costs: 10% x $1,348.68 (remaining DAC after Year 9) = $134.87 Net income reported: $2,000 – $134.87 = $1,865.13

By the end of the policy term, all the deferred acquisition costs have been amortized, and the full premium revenue is recognized as income. Thus, in the final year, the reported net income is substantially higher.

This example demonstrates how the amortization of deferred acquisition costs affects the reported income of an insurance company over the life of a policy. Initially, the reported income is lower due to the amortization of costs, but as the policy generates premium revenue and the costs are gradually depleted, the reported income increases

Note: In case you are looking for a Product Management course, I would highly recommend joining this cohort-based course – ISB Executive Education – Product Management program

PS: You can connect with me for review or referral discount (link for referral discount)