In the OYO IPO DRHP submitted to SEBI in September 2021 and revised DRHP submitted in November 2022, it is clearly mentioned that OYO is not a hotel chain. They have an asset-light business model as they do not own the hotels listed on their platform. Also, 99.9% of their storefronts do not have contracts with minimum guarantees or fixed pay-out commitments. OYO is a technology platform organizing the highly fragmented global hospitality ecosystem. Their full-stack technology suite integrates more than 40 products and services across digital sign-up and onboarding, revenue management, daily business management, and D2C stacks into their two flagship Patron applications, Co-OYO and OYO OS

Tech-Products mentioned in OYO IPO DRHP

- OYO Tariff Manager: to help hotels/storefronts capture last-mile inputs for any changes in pricing

- Discover OYO: to help hotels/storefronts to increase their revenue generation potential by enabling them to offer discounted room rates to new Customers

- OTA Powerplay: to help boost hotels/storefronts sales for our Patrons through OTA platforms

- Flash Sales: to optimize unused inventory and improve overall revenue generation potential for hotels/storefronts

- OYO 360: OYO 360 is a fully digital product that enables Patrons to sign up to our platform and seamlessly list their storefronts in under 30 minutes

- OYO ‘B’ and Super Agent portals for corporate and travel agent tie-ups: OYO B corporate hotel booking solution aims to simplify business travel bookings for corporate Customers by managing all business travel accommodation bookings through a single platform, allowing employees to book their own business travel accommodation and providing expense management solutions

- OYO Wizard: OYO’s customer loyalty program. During Fiscal 2021, booked nights per customer for OYO Wizard members in India with paid subscriptions was 1.5 times higher than that of non-members

OYO Rooms value addition to Hotels and Customers

.Value for hotel/storefront: Transform fragmented, unbranded, and underutilized hospitality assets into branded, digitally-enabled storefronts with higher revenue generation potential.

- After 12 weeks of joining the OYO platform, OYO-powered hotel storefronts generated 1.5 to 1.9 times more revenue on average compared with the average revenue estimated at independent hotels of a similar size in India, Indonesia, and Malaysia respectively in 2019 (source: OYO IPO DRHP)

- In Europe, OYO-powered home storefronts earned an average of 2.4 times more revenue in 2019 compared with the average revenue estimated at an independently managed home in Europe in 2019 (source: OYO IPO DRHP)

Value for Customer: Access to a broad range of high-quality hotels at compelling price points, along with customer loyalty and referral programs, generate significant organic and repeat demand for bookings

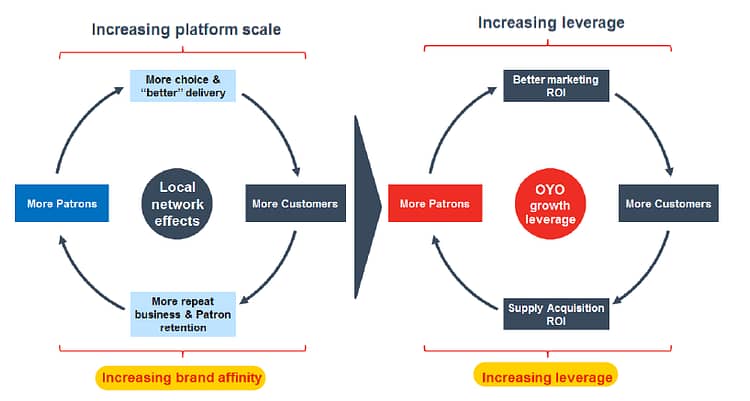

OYO benefits significantly from the flywheel effect of the interplay between the supply and demand sides of its technology platform, underpinned by strong local network effects and operating leverage.

More Hotels -> More choice and better delivery -> More Customers -> More repeat business and Hotel retention -> Increase in brand equity

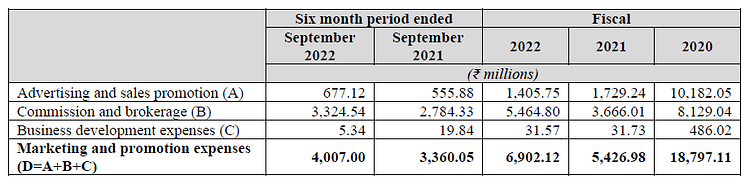

This increase in brand equity leads to increase in leverage of OYO which discussing terms with hotels, leading to better marketing ROI (Advertising and sales promotion cost have reduced from INR 10,000 million in FY 2020 to INR 1,400 million in FY 2022) (source: OYO’s DRHP)

Target Market/Audience

Segment: Currently OYO is focussed on the short-stay accommodation segment i.e.: stays of up to one month. This market comprises stays across hotels, homes, guesthouses, bed and breakfasts and campsites for tourists and travellers.

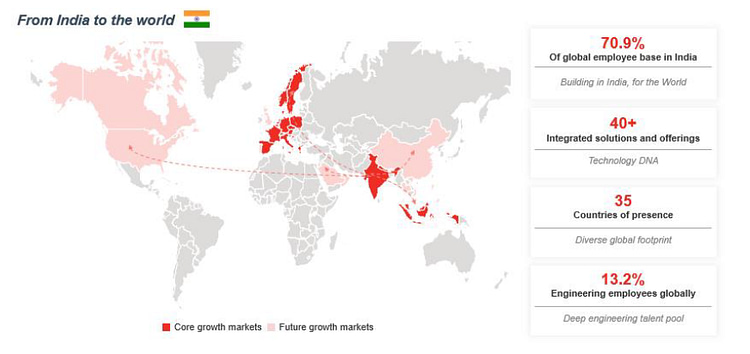

Geography: In terms of scale, OYO has 157,344 storefronts across more than 35 countries listed on their platform. OYO has the largest footprint in terms of hotel storefronts in India and SEA and the second largest footprint in Europe in terms of home storefronts among full stack short-stay accommodation players.

Same Day booking: Same-day bookings for hotel storefronts increased from 59.5% in Fiscal 2020 to 69.5% in Fiscal 2021

Same-city demand: A significant share of OYO’s bookings are from same-city demand, being storefront bookings from customers located in the same base city due to affordability, availability, and standardization of its storefronts

Market Penetration and Development strategy of OYO (from IPO DRHP)

Current Market Penetration and Development strategy for Storefronts

- BD model: In 2019, OYO averaged addition of 1.8 storefronts per business development manager per quarter

- OYO Saathi re-seller signup model: OYO ties up with entrepreneurs with strong local networks to act as our re-sellers and facilitate the listing of storefronts on OYO’s platform through OYO Saathi re- seller model. During June 2021, 25.9% of storefronts onboarded in India were onboarded through OYO Saathi.

- OYO 360 self-signup model: OYO 360 is a fully digital product that enables Patrons to sign up to our platform and seamlessly list their storefronts in under 30 minutes

- Mergers and Acquisitions: OYO have 40+ joint-ventures/subsidiaries across the globe. E.g.: In Europe, acquisition of TUI’s vacation home portfolio and successful integration of their supply base and team into OYO Europe portfolio helped to strengthen OYO’s market position in Germany and Austria and deepen their presence across Europe

These models help OYO to expand their hotel/storefront network and increase their storefront supply in a cost-effective and scalable manner by providing access to untapped segments that are more difficult to cover through on-the-ground business development executives. BD expenses have reduced from INR 468 million in FY 2020 to INR 31 million in FY 2022.

Current Market Penetration and Development Strategy for Customers

- Online Travel Aggregators (OTAs): Strategic partnerships with leading third-party OTAs provide access to their extensive customer network which in turn helps OYO to increase their hotels/storefronts reach and their revenue generation potential

- OYO Wizard loyalty program: During Fiscal 2021, booked nights per customer for OYO Wizard members in India with paid subscriptions was 1.5 times higher than that of non-members (source: OYO IPO DRHP)

- “Invite & Earn” referral program: Enables existing Customers to earn OYO credits when they successfully refer new Customers that sign up and book their first hotel/storefront

Click here to download OYO IPO DRHP – September 2021

Click here to download OYO IPO DRHP Addendum – November 2022

Click here to download OYO IPO DRHP Addendum – November 2022

Click here to download OYO IPO DRHP – September 2021

Note: In case you are looking for a Product Management course, I would highly recommend joining this cohort-based course – ISB Executive Education – Product Management program

PS: You can connect with me for review or referral discount (link for referral discount)