Impact funds in venture capital (VC) refer to investment funds that specifically focus on supporting and financing businesses and startups that have a positive social or environmental impact. These funds prioritize not only financial returns but also measurable and beneficial outcomes for society and the planet.

The concept of impact investing has gained significant traction in recent years as investors increasingly seek to align their financial objectives with their values. Impact funds aim to support companies and projects that address various global challenges, such as climate change, poverty, healthcare access, education, sustainable energy, and more.

Key Characteristics of Impact Funds

Social and Environmental Focus: Impact funds target companies that have a clear mission to make a positive impact on society and the environment. These companies may be working on innovative solutions to address pressing global issues.

Dual Bottom Line: Impact funds consider both financial returns and measurable impact. They seek to achieve competitive financial returns while making a positive difference in the world.

Impact Measurement and Reporting: These funds place an emphasis on tracking and measuring the impact of their investments. They often use specific metrics and reporting frameworks to assess the social and environmental outcomes of their portfolio companies.

Diverse Investment Sectors: Impact funds may invest in various sectors, such as clean energy, healthcare, education, agriculture, sustainable technology, and more. The focus is on businesses that contribute to positive change and sustainability.

ESG Integration: Environmental, Social, and Governance (ESG) factors are often considered when evaluating potential investments. Companies with strong ESG practices are more likely to attract funding from impact funds.

Investor Alignment: Impact funds attract investors who prioritize not only financial returns but also making a positive impact. These investors are often known as impact investors.

Impact funds in VCs play a crucial role in driving positive change by supporting and accelerating the growth of purpose-driven companies. They contribute to fostering a more sustainable and equitable future while demonstrating that profitable investments can also align with positive societal outcomes.

Historical Evolution and Milestones of Impact Investing

Origins in Ethical Investing (1960s – 1970s): The roots of impact investing can be traced back to the 1960s and 1970s when socially responsible investing (SRI) gained popularity. Investors began excluding certain industries, such as tobacco and firearms, from their portfolios due to ethical concerns. This marked the early stages of considering societal impact alongside financial returns.

The Emergence of Community Investing (1980s – 1990s): During the 1980s and 1990s, the concept of community investing took shape. Community development financial institutions (CDFIs) and microfinance institutions emerged to provide financial services to underserved communities and entrepreneurs. This period witnessed a focus on investing in projects with a direct social impact, particularly in disadvantaged regions.

Coining of the Term “Impact Investing” (2007): The term “impact investing” was officially coined in 2007 during a gathering at the Rockefeller Foundation’s Bellagio Center. The meeting brought together investors, entrepreneurs, and philanthropists interested in exploring new ways of deploying capital for social and environmental benefits. The term gave a clear identity to the growing movement.

The Global Financial Crisis and the Rise of Socially Responsible Investments (2008): The global financial crisis of 2008 prompted increased interest in socially responsible investments and impact-focused initiatives. Investors sought to avoid the risks associated with conventional investment practices, leading to a surge in demand for investments with sustainable and ethical considerations.

Introduction of the UN Sustainable Development Goals (2015): In 2015, the United Nations launched the Sustainable Development Goals (SDGs), a set of 17 global objectives to address various societal and environmental challenges. The SDGs provided a comprehensive framework for impact investors to align their investments with specific social and environmental targets.

Growth of Impact Investment Funds (2010s – Present): The 2010s witnessed a significant rise in the establishment of dedicated impact investment funds and financial products. Institutional investors, including pension funds and endowments, began allocating substantial capital to impact-focused funds, signaling a growing mainstream acceptance of impact investing.

Impact Investing Gains Traction in Private Equity and Venture Capital (2010s – Present): Private equity and venture capital sectors also embraced impact investing. Impact funds started focusing on early-stage startups and growth-stage companies that demonstrated potential for both financial returns and positive impact. This development expanded the scope of impact investing to high-growth, innovative ventures.

Increase in Impact Measurement and Reporting (2010s – Present): As impact investing gained momentum, there was an increasing emphasis on impact measurement and reporting. Various frameworks and standards, such as the Global Impact Investing Network’s (GIIN) Impact Reporting and Investment Standards (IRIS), emerged to help investors assess and communicate the social and environmental outcomes of their investments.

Mainstream Recognition and Impact Investing Alliances (2010s – Present): Impact investing gained recognition from mainstream financial institutions and regulatory bodies. Organizations like the GIIN and the Impact Management Project (IMP) were formed to bring together investors, entrepreneurs, and policymakers to promote best practices and collaborative efforts in the impact investing ecosystem.

The Evolution Continues (Present and Beyond): Impact investing continues to evolve and diversify, with ongoing innovations in impact finance, green bonds, social impact bonds, and impact-focused financial technology platforms. The movement is poised to grow further as more investors seek to deploy capital in ways that create positive change while achieving competitive financial returns.

Impact Investment Strategies

- Early-Stage Investing in Innovative Startups with Social and Environmental Missions: One of the primary impact investment strategies involves funding early-stage startups that have a clear social or environmental mission. These ventures often focus on addressing specific challenges, such as climate change, poverty, healthcare access, education, or sustainable technology. Impact investors recognize the potential of these innovative ideas and provide crucial seed funding and mentorship to help these startups grow and create a positive impact. By supporting early-stage ventures, impact investors play a vital role in nurturing groundbreaking solutions and fostering a pipeline of impactful businesses.

- Growth-Stage Investments in Scaling Impactful Businesses: As impact-focused startups gain traction and demonstrate the viability of their business models, they often require additional capital to scale their operations and expand their impact. Growth-stage impact investments are aimed at supporting these businesses during their scaling phase. Impact investors provide the necessary growth capital and strategic support to help these ventures reach a larger audience, enter new markets, and make a more significant difference in the lives of people and the environment. This stage of investing enables successful impact-driven businesses to achieve sustainability and further amplify their positive outcomes.

- Impact-Focused Funds vs. Traditional VC Funds with ESG Considerations: Impact-focused funds are distinct from traditional venture capital (VC) funds that merely consider Environmental, Social, and Governance (ESG) factors as part of their investment criteria. While traditional VC funds may incorporate some ethical considerations, impact-focused funds have a specific mandate to prioritize social and environmental impact alongside financial returns. Impact funds seek out companies with a clear mission to generate positive change, whereas traditional VC funds may invest in any promising opportunity, regardless of its impact on society or the environment. Impact-focused funds are driven by a dual bottom line, aiming to achieve both financial profitability and measurable positive outcomes, making them more aligned with investors seeking to create meaningful change through their investments.

Impact investment strategies encompass a range of approaches to support ventures that drive positive social and environmental change. Early-stage investments nurture innovative startups with purpose-driven missions, while growth-stage investments fuel the expansion of impactful businesses. Impact-focused funds prioritize measurable impact alongside financial returns, setting them apart from traditional VC funds with ESG considerations. Together, these strategies contribute to a more sustainable and equitable future, showcasing the power of aligning capital with purpose.

Impact Investment Areas for Societal Impact

Impact funds have successfully demonstrated that financial viability and societal impact can go hand in hand. Numerous businesses have proven that investing in positive change can yield impressive financial returns while addressing pressing global challenges.

The Ripple Effect: Impact funds that invested in water and sanitation projects in developing countries showcased a compelling example of financial viability and societal impact. Improved access to clean water and sanitation led to healthier communities, reduced healthcare costs, and increased productivity, ultimately benefiting local economies.

Renewable Energy Ventures: Impact funds backing renewable energy projects have witnessed significant financial success. Companies involved in wind, solar, and other clean energy technologies have demonstrated competitive returns while contributing to the transition to a more sustainable energy future.

Inclusive Finance Initiatives: Impact funds supporting microfinance institutions and financial inclusion projects have not only provided access to financial services for underserved populations but have also shown attractive financial returns. Empowering these communities with financial tools has led to improved livelihoods and economic growth.

Education for All: Impact funds that invested in education technology platforms and affordable educational institutions have witnessed considerable growth and positive impact. By providing quality education to marginalized communities, these companies have helped break the cycle of poverty and empower the next generation with better opportunities.

Impact Investment Areas in Financial Sector

Microfinance Institutions (MFIs): Microfinance institutions provide financial services, including small loans and savings accounts, to low-income individuals and entrepreneurs in underserved communities. Impact funds have supported MFIs globally, demonstrating their financial viability by achieving sustainable operations and repayment rates. These MFIs have had a significant societal impact by empowering borrowers, particularly women, to start or expand small businesses, improve household incomes, and lift themselves out of poverty.

Green Bonds and Sustainable Finance: Impact funds have participated in the issuance and investment of green bonds, which are used to finance environmentally friendly projects, such as renewable energy installations and energy-efficient buildings. These investments demonstrate financial viability as green bonds have attracted substantial investor interest and generated competitive returns. Moreover, the projects funded by green bonds have contributed to mitigating climate change and promoting sustainable development.

Social Impact Bonds (SIBs): Social Impact Bonds are innovative financial instruments where private investors fund social programs, and the government repays the investors based on the program’s success in achieving predefined social outcomes. Impact funds have been involved in SIBs, particularly in areas such as reducing recidivism rates, improving educational outcomes for at-risk students, and providing support to vulnerable populations. These initiatives showcase financial viability by aligning financial incentives with positive societal outcomes.

Ethical Banking and Responsible Investments: Some impact funds support and invest in ethical banks and responsible investment platforms that prioritize social and environmental criteria in their operations and investment strategies. These financial institutions demonstrate financial viability by attracting customers who value transparency, sustainability, and ethical practices. They have a societal impact by directing capital away from harmful industries and towards companies that promote environmental and social responsibility.

Impact Investing Funds and Platforms: Impact funds dedicated to the finance industry focus on supporting fintech startups and financial institutions that promote financial inclusion, democratize access to financial services, and address systemic financial inequalities. These funds demonstrate financial viability by fostering innovation and growth in the finance sector. Their societal impact is evident in expanding financial access to marginalized communities, improving financial literacy, and fostering economic development.

Community Development Financial Institutions (CDFIs): Community Development Financial Institutions are specialized financial institutions that provide affordable and accessible financial services in underserved communities. Impact funds have invested in CDFIs, which have demonstrated financial viability through sustainable operations and positive community-level impacts. These institutions help stimulate local economic growth, create jobs, and support affordable housing and small businesses.

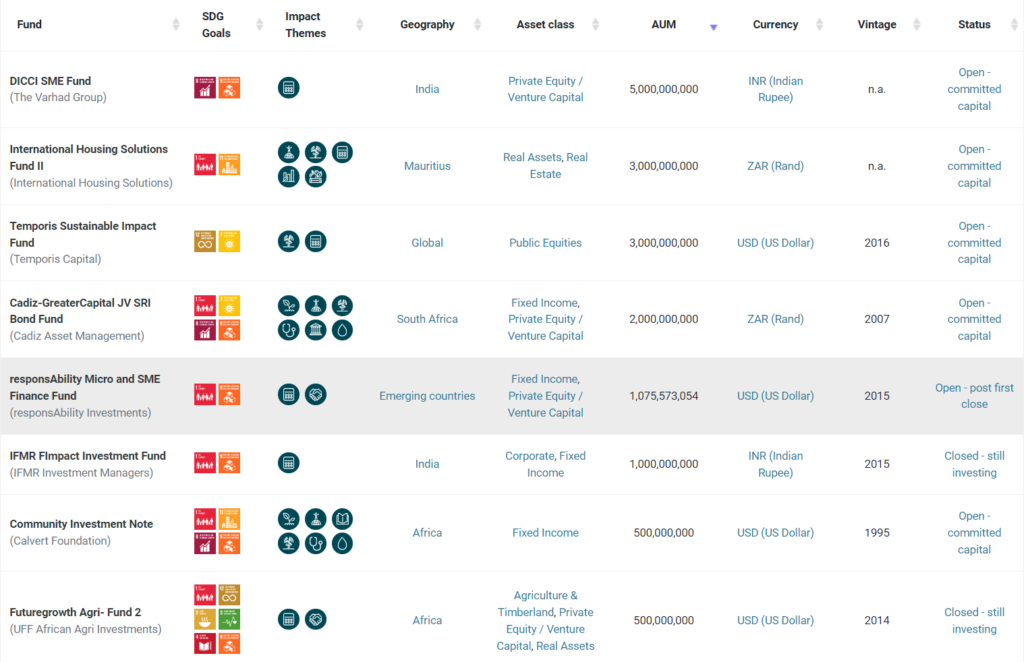

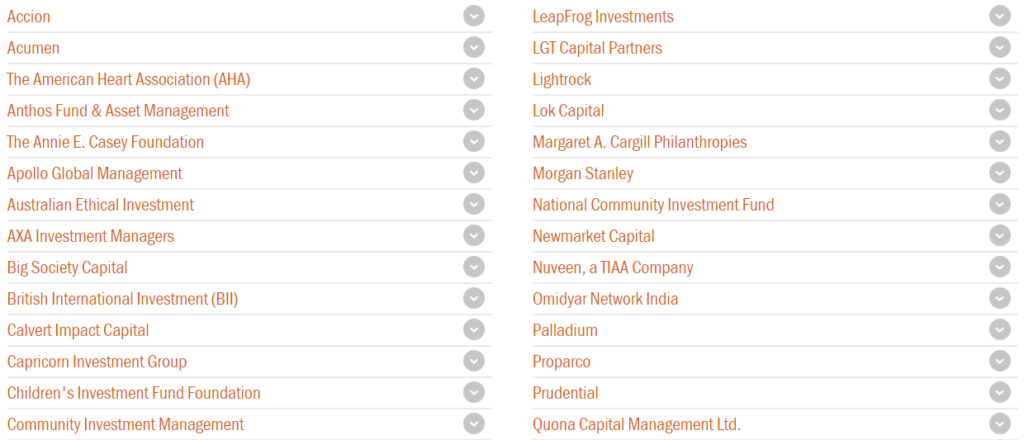

List of Impact Funds

1. List of 514 Impact Funds – Click Here

2. Members of Impact Investors Council – Click Here

3. List of 309 Impact Investors – Click Here

4. Members of GIIN Investor’s Council – Click Here

Note: In case you are looking for a Product Management course, I would highly recommend joining this cohort-based course – ISB Executive Education – Product Management program

PS: You can connect with me for review or referral discount (link for referral discount)